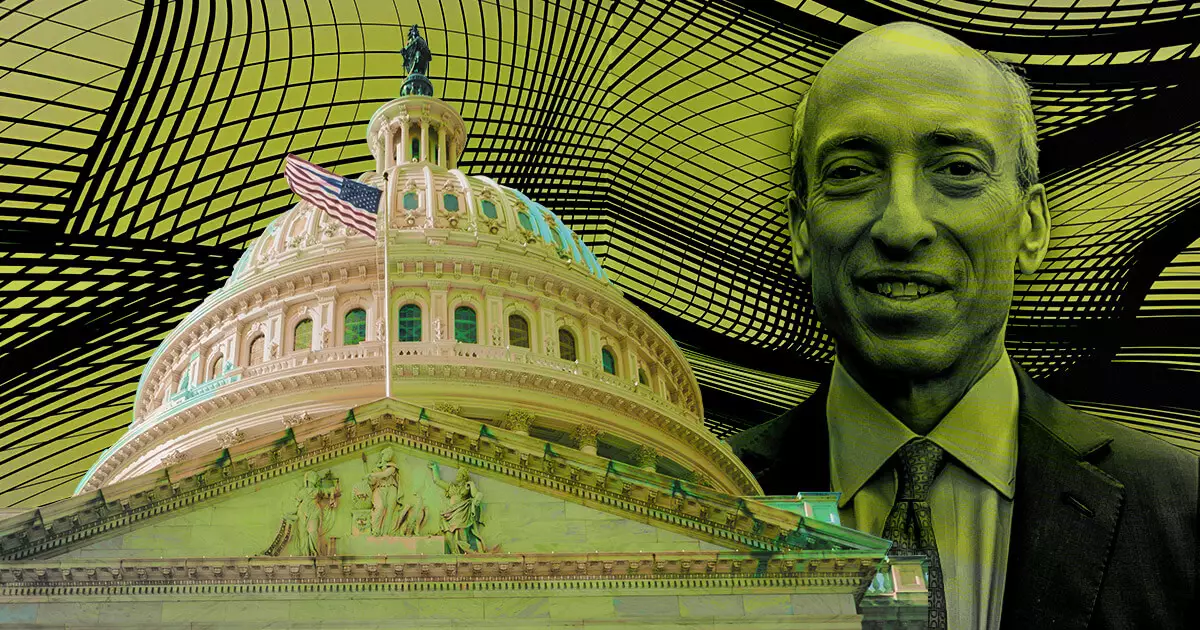

In a bold and controversial move, U.S. Congressman Warren Davidson, supported by House Majority Whip Tom Emmer, has called for the firing of SEC Chair Gary Gensler in 2024. This decision comes as a response to alleged corruption and abuses of power within the Securities and Exchange Commission (SEC). Throughout 2023, tensions between the SEC and the digital asset sector have been on the rise, prompting Davidson to address the strained relationship between regulatory authorities and the industry.

One of the major concerns raised by Congressman Warren Davidson is Gensler’s enforcement-first regulatory approach. Davidson believes that this approach has created friction between the SEC and the digital asset industry, hindering its growth and innovation. To combat these issues, Davidson introduced the SEC Stabilization Act earlier this year.

The SEC Stabilization Act proposed by Davidson aims to restructure the SEC and remove Gensler from his position as Chair. The Act argues that Gensler’s leadership has been marked by a “long series of abuses,” necessitating a change in leadership. The proposed restructuring includes the addition of a sixth commissioner and an Executive Director to oversee day-to-day operations. However, it clarifies that all rulemaking, enforcement, and investigation powers will remain with the commissioners.

The primary goal of the proposed restructuring is to prevent any single political party from holding more than three commissioner seats. By doing so, it aims to safeguard U.S. capital markets from potential political agendas that may compromise their integrity. Davidson emphasizes the need for reform within the SEC, stating, “U.S. capital markets must be protected from a tyrannical Chairman, including the current one. It’s time for real reform and to fire Gary Gensler as Chair of the SEC.”

Supporting Congressman Davidson’s sentiments, House Majority Whip Tom Emmer highlights the importance of clear and consistent oversight in the interest of American investors and the industry as a whole. Emmer emphasizes the need to prioritize the well-being of investors and market participants over political maneuvering.

Additional support for the removal of Gensler and the passage of the SEC Stabilization Act has been voiced through various tweets. One tweet specifically targets the accredited investor rule, claiming that it protects the interests of a privileged class. Another tweet accuses Gensler’s SEC of favoring Wall Street over Main Street and endorses Davidson’s bill as a way to hold the SEC accountable.

The current situation between U.S. Congressman Warren Davidson, with the backing of House Majority Whip Tom Emmer, and SEC Chair Gary Gensler marks a critical juncture in the ongoing dialogue surrounding regulatory approaches and accountability within the U.S. financial regulatory framework. The calls for Gensler’s firing and the proposed SEC Stabilization Act reflect mounting concerns about corruption and abuses of power within the SEC. As the digital asset sector continues to evolve, it is crucial for regulatory authorities to foster a balanced and supportive environment that promotes innovation while also protecting the interests of investors. Only time will tell how these tensions will play out and whether meaningful reforms will be implemented to address these concerns.

Leave a Reply