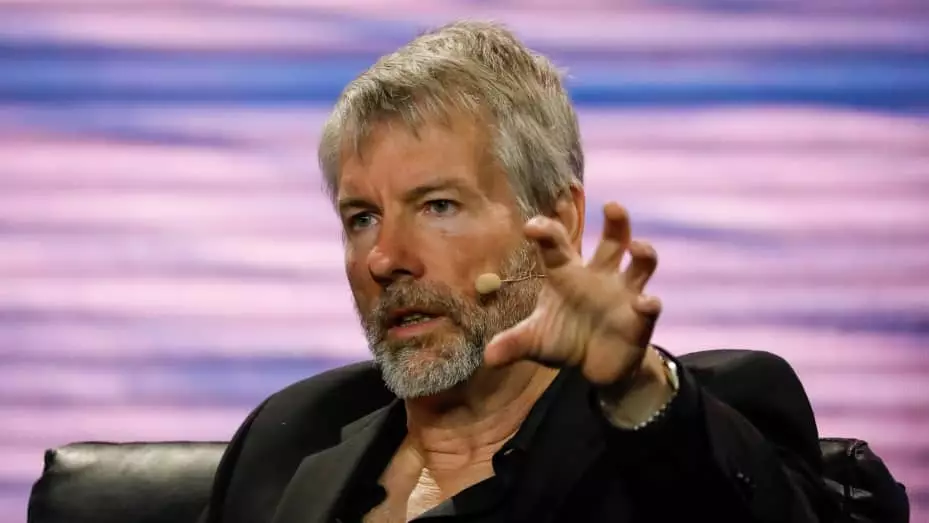

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has made it clear that he and his company are dedicated to buying Bitcoin indefinitely. Despite the significant profits from their BTC holdings, Saylor emphasized during an interview with Bloomberg that they have no intention of selling. He views BTC as the ultimate exit strategy and a robust asset, comparing it to established giants like Apple, Google, and Microsoft.

BTC, although not a company, competes with traditional asset classes such as gold and the S&P stock market index. Saylor noted that there isn’t enough space in the capital structure of the top companies to accommodate trillions of dollars in capital, making Bitcoin a direct competitor to gold and real estate as a store of value. He believes that Bitcoin’s technical superiority will continue to attract capital away from other assets, stating that there is no reason to sell the winning asset to purchase losing ones.

Saylor’s enthusiasm for Bitcoin extends to the recently launched spot Bitcoin exchange-traded funds (ETFs), which he considers to be the most groundbreaking development on Wall Street in the past thirty years. He drew parallels between the ETFs and the historic creation of the S&P 500 fund, emphasizing their importance in the financial landscape.

MicroStrategy, under Saylor’s leadership, became the first publicly traded company to accumulate Bitcoin starting in 2020. Since then, the firm has continued to add to its BTC holdings, with the most recent purchase of 850 BTC bringing the total to 190,000 BTC. These coins were bought at an average price of $31,224 each and are currently valued at over $10 billion.

In December, Saylor predicted a surge in Bitcoin demand by 2024, a forecast that is already being realized. The demand for BTC from spot Bitcoin ETFs is nearly ten times higher than the available supply from miners, indicating a growing appetite for the digital asset in the financial markets.

By remaining steadfast in his commitment to Bitcoin and continuously adding to MicroStrategy’s holdings, Michael Saylor is leading the charge in reshaping the perception of cryptocurrencies as a legitimate store of value and investment option in the traditional financial world.

Leave a Reply