Jimmy Song, a well-known figure in the Bitcoin community, recently shared his perspective on the long-awaited Bitcoin Exchange-Traded Fund (ETF). While some individuals, like Edward Snowden, remain skeptical about the potential approval of a Bitcoin ETF, others believe that it could legitimize the cryptocurrency for institutional investors. Jimmy Song, however, takes a different stance. He falls into the “I don’t care camp,” highlighting that futures ETFs and spot ETFs have already been available in different parts of the world and the US, respectively. While institutional investors may find it easier to access the BTC ecosystem through ETFs, Song warns about the dangers of employing short ETFs, as redemptions of the spot product would require actual Bitcoin delivery.

Bitcoin Ordinals, a speculative phenomenon that recently occurred in the Bitcoin market, caught the attention of many. Jimmy Song categorizes this event as a “normal pump and dump,” often seen in altcoins like during the DeFi summer and the NFT craze. The unexpected occurrence of such a scheme on Bitcoin surprised Song, but he believes that the hype has already faded away and ultimately holds no significance.

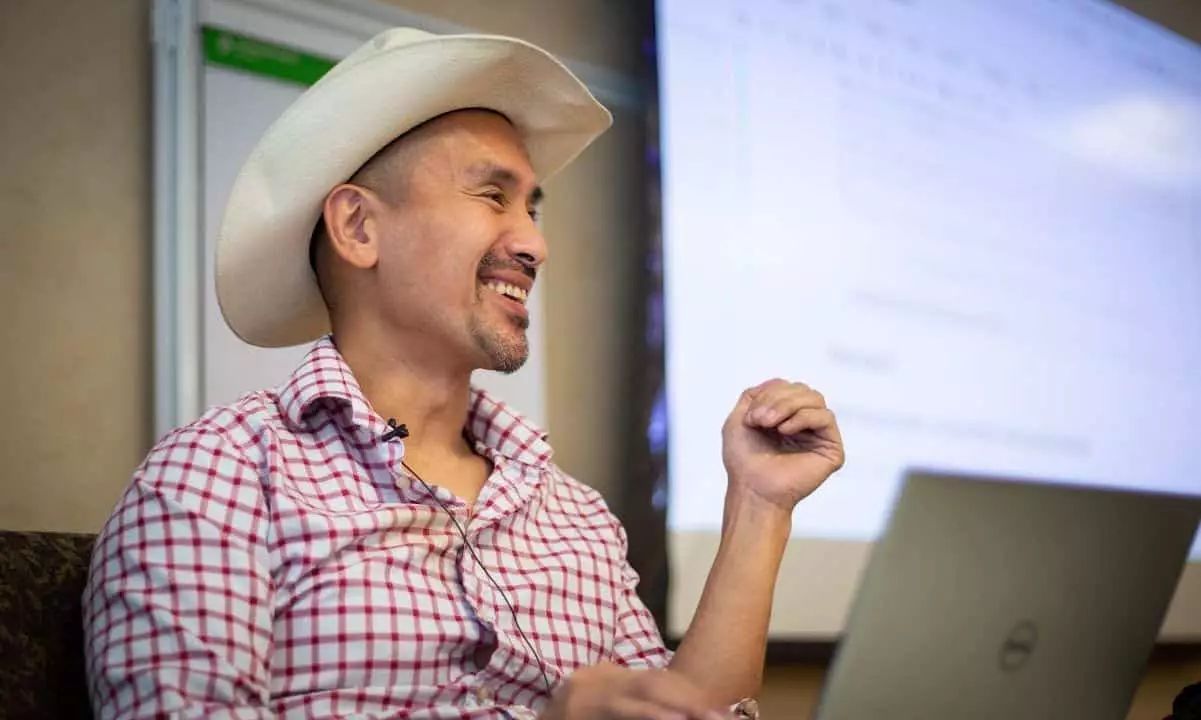

Five years ago, Jimmy Song famously wore a cowboy hat to symbolize Bitcoin’s Wild West era, characterized by a lack of regulations and widespread adoption. When asked about any changes he has witnessed in this regard, Song noted that although some authorities have prosecuted individuals like Sam Bankman-Fried, indicating some regulation, Bitcoin remains in a Wild West state. He acknowledged the presence of more regulators who recognize the uniqueness of Bitcoin compared to other assets, but the industry still lacks comprehensive regulation.

In his earlier interview, Song expressed his belief that more people would seek “freedomish” assets like Bitcoin within the next 15 years, contributing to BTC’s adoption curve. However, recent global events, such as the COVID-19 pandemic and the introduction of Central Bank Digital Currencies (CBDCs), have challenged this projection. Song acknowledges that many individuals complied with government measures during the pandemic and when vaccines were introduced but now reconsider their choices due to controversial reports and their desire for better education. While some may eventually comply with CBDCs upon their full launch, a growing portion of the population has become skeptical, as evidenced by protests and resistance in various countries. Song predicts a gradual shift towards a more freedom-minded population, although it may take several decades.

Governments worldwide responded to the financial pressures caused by the COVID-19 pandemic by printing substantial amounts of fiat money. This approach aimed to alleviate economic strain, although its long-term impact remains uncertain. Jimmy Song’s latest book, titled “Fiat Ruins Everything,” focuses on Bitcoin’s advantages and aims to resonate with Bitcoiners who already own the cryptocurrency. The book highlights the extent of fiat corruption and aims to inspire Bitcoin holders to recognize the flaws of the existing system.

Jimmy Song provides valuable insights into various aspects of the Bitcoin landscape. From his apathetic stance on Bitcoin ETFs to his critical analysis of Bitcoin Ordinals and his observations on the evolving regulatory environment, Song demonstrates a nuanced understanding of the digital currency space. Furthermore, his predictions regarding the future of Bitcoin adoption and the impact of fiat money provide valuable food for thought. As the Bitcoin ecosystem continues to evolve, it is crucial to consider perspectives like Jimmy Song’s to navigate the complexities of the market effectively.

Leave a Reply