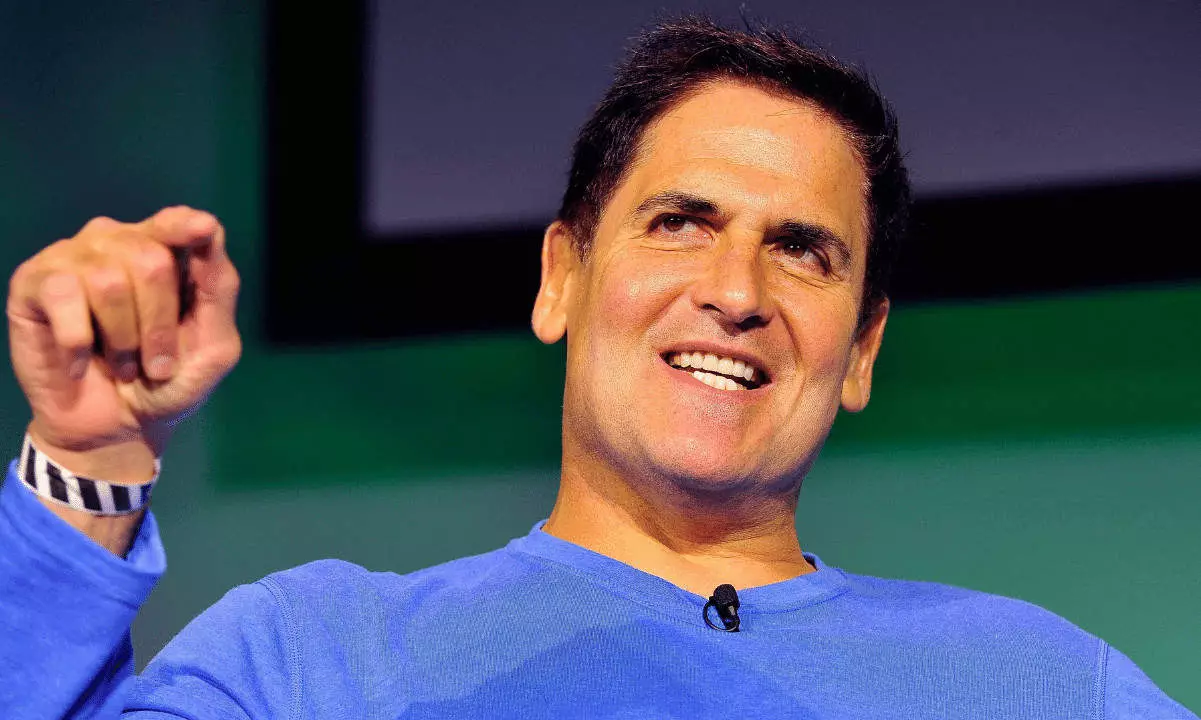

In a recent impromptu Ask Me Anything (AMA) session on X, entrepreneur and billionaire Mark Cuban shared his thoughts on various cryptocurrency ventures, including Bitcoin, Ethereum, and others. Let’s critically analyze Cuban’s views on these digital assets, as well as his stance on Non-Fungible Tokens (NFTs) and decentralized finance (DeFi).

When questioned about his preferred cryptocurrency ventures beyond Bitcoin and Ethereum, Cuban mentioned Polygon and Injective, in which he claimed to have invested. However, his response, “I’ve invested in both (DYOR),” leaves much to be desired. It would have been more insightful and beneficial to his followers if he had delved deeper into his reasons for investing in these particular projects.

One area where Cuban’s views on cryptocurrency are more apparent is his support for Dogecoin. The Dallas Mavericks, Cuban’s NBA team, made headlines in 2021 for accepting Dogecoin as a payment method. However, when asked about this support, Cuban’s response was disappointingly brief, leaving the reader craving for more information. It would have been valuable to know his reasons for standing behind Dogecoin and his thoughts on its future potential.

Unlike many crypto enthusiasts who are fascinated by the surge in interest in Solana memecoins like Dogwifhat, Cuban seems unimpressed. When asked about the viral Dogwifhat meme, he dismissed it by saying, “I don’t think about it.” While Cuban’s response may reflect his personal opinion, it lacks depth and fails to offer any substantial insight into the potential impact of such memes on the crypto market.

One area where Cuban has established himself as a connoisseur is Non-Fungible Tokens (NFTs). However, his perspective on this subject seems limited to their role as collectibles. While it is true that NFTs can be valuable in the art and collectibles market, Cuban fails to acknowledge the broader potential and use cases of NFTs beyond mere speculation. A more comprehensive analysis of NFTs’ implications for various industries would have been beneficial.

In the realm of decentralized finance (DeFi), Cuban brings forth the need for new ideas with more utility. While he admits to having invested in DeFi, he expresses skepticism about its current state. His hope for DeFi to trend in a more positive direction lacks specificity and falls short of providing any actionable insights for those interested in this space.

Furthermore, Cuban’s skepticism about tokenizing real-world assets as a “hard sell” contradicts the bullish prediction of Larry Fink, who believes that all assets will eventually be tokenized. Cuban fails to elaborate on his skepticism, leaving readers with unanswered questions regarding the viability and potential advantages of tokenizing real-world assets.

Although Mark Cuban’s perspectives on cryptocurrency, NFTs, and DeFi provide some insights, they are often lacking in depth and fail to offer the required analysis to fully comprehend the nuances of these emerging technologies. Cuban’s brief and superficial responses throughout the AMA leave much room for improvement in terms of providing valuable and critical insights into the world of cryptocurrencies and blockchain technology. As a prominent figure in both traditional finance and the crypto space, a more comprehensive and analytical approach to his opinions would greatly benefit his followers and the broader crypto community.

Leave a Reply