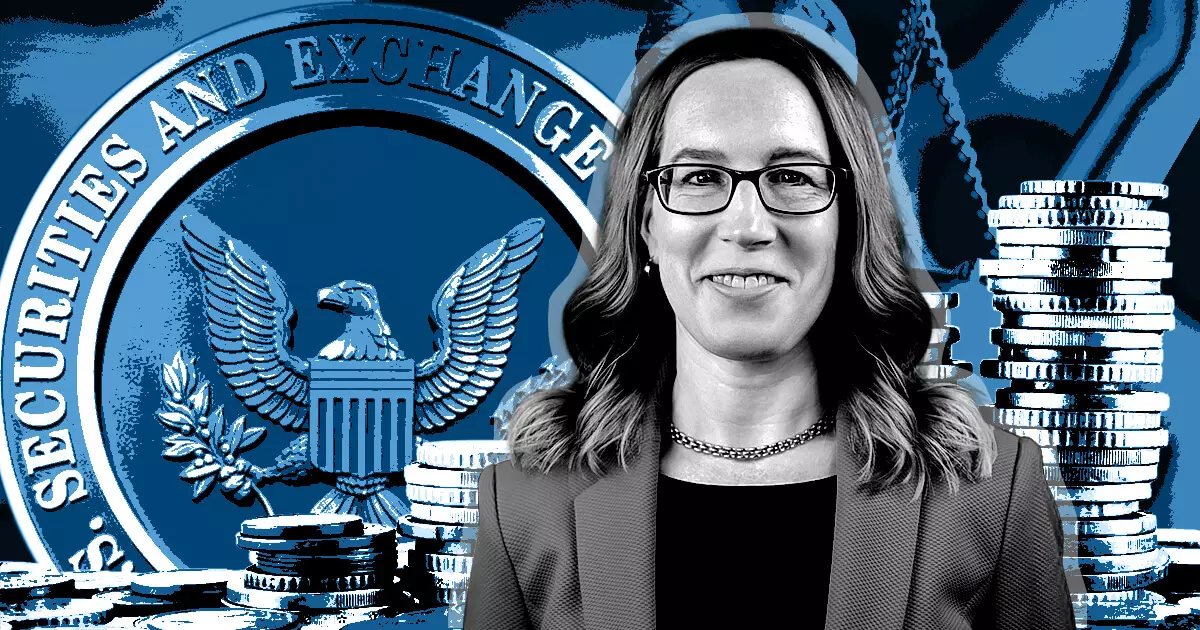

LBRY Inc., the firm behind the LBRY blockchain and content-sharing network, recently announced that it would not appeal its legal loss against the Securities and Exchange Commission (SEC). This decision marks the formal end of the legal proceedings surrounding LBRY’s regulatory compliance. As a result, the firm will be forced to shut down and enter receivership to cover its outstanding debts, including those owed to the SEC. However, Commissioner Hester Peirce has expressed skepticism about the value of this outcome, questioning whether investors and the market are truly better off after the SEC’s intervention.

The Arbitrariness of the SEC

Commissioner Peirce has criticized the SEC’s regulation by enforcement approach, highlighting the arbitrariness and real-life consequences it brings to the crypto sector. Notably, the SEC did not allege that LBRY committed any fraudulent activities. Unlike many other projects, LBRY fulfilled its promises, having a functional blockchain and a popular content-sharing platform. Despite these accomplishments, the SEC adopted an extremely strict approach, initially seeking $44 million in penalties and demanding the burning of all LBRY tokens. Although the penalty request was ultimately reduced to $111,614, Commissioner Peirce insists that the SEC’s punitive actions outweighed any harm faced by investors.

Uncertainty in Token Regulation

One of Commissioner Peirce’s core arguments against the SEC is the lack of clarity regarding the application of securities laws to token projects. She contends that there is currently no viable path for companies like LBRY to register their functional token offerings. As a result, the SEC’s regulatory framework imposes unnecessary burdens and hinders innovation within the blockchain industry. Instead of spending considerable time and resources litigating against LBRY, Commissioner Peirce suggests that the SEC should focus on creating a clear regulatory framework that allows token projects to thrive within the boundaries of the law.

Commissioner Peirce asserts that the SEC’s harsh approach in the LBRY case was disproportionate to any potential harm faced by investors. She believes that the SEC’s “scorched earth” tactics could have been better utilized to develop a comprehensive regulatory framework for blockchain projects. By redirecting its efforts towards creating guidelines and standards, the SEC could foster an environment where innovation and compliance go hand in hand. Commissioner Peirce warns that the SEC’s current approach will discourage future blockchain experiments, stifling progress in the industry.

Despite the SEC’s actions, Commissioner Peirce points out that the court did not address the security status of LBRY’s token (LBC) or secondary sales of LBRY. This ambiguity means that there is still a chance for the LBRY blockchain to continue operating within the legal framework. However, the lack of clarity and the SEC’s heavy-handed response have cast a shadow of uncertainty over the project’s future.

Commissioner Hester Peirce’s criticism of the SEC’s actions against LBRY raises pertinent questions about the agency’s regulatory approach. As the SEC continues to navigate the evolving landscape of blockchain and cryptocurrencies, it must strike a balance between investor protection and fostering innovation. By developing clear guidelines and working collaboratively with industry participants, the SEC can create an environment where regulatory compliance and technological advancement can coexist.

Leave a Reply