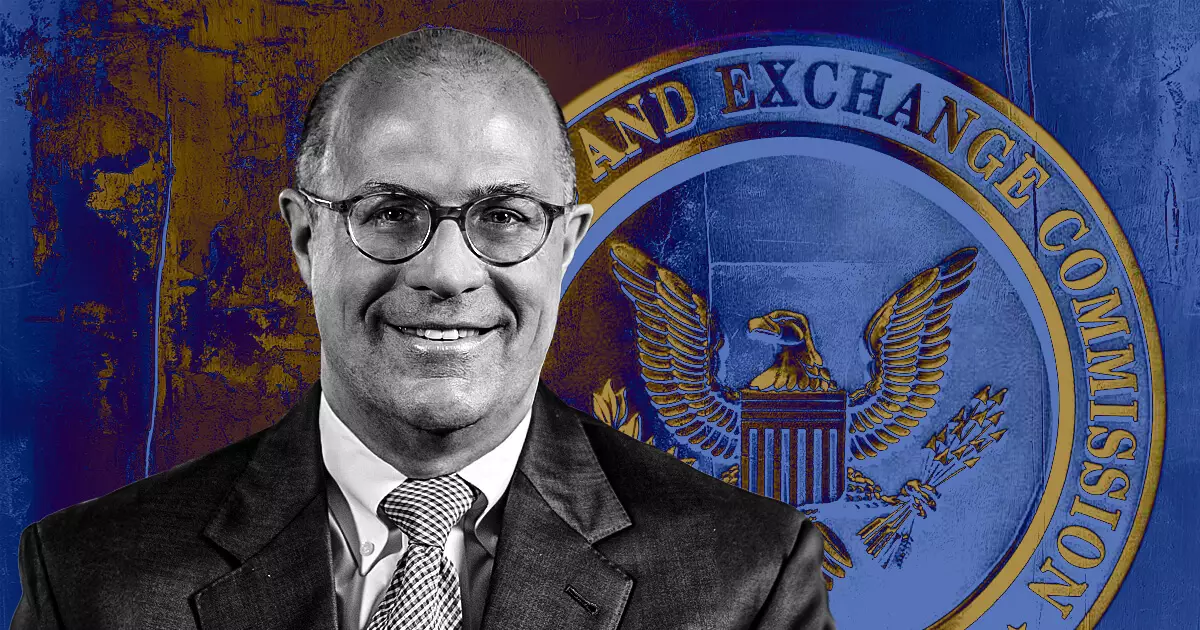

Recent rumors emerged suggesting that Christopher Giancarlo, the former Chair of the Commodity Futures Trading Commission (CFTC), might be in line to take over as Chair of the US Securities and Exchange Commission (SEC). Giancarlo, however, promptly dismissed these speculations, stating that he is not interested in any crypto-related positions within the US Treasury Department either. He emphasized his reluctance to delve back into the regulatory complexities shaped by his predecessor, highlighting a sense of aversion towards dealing with the consequences of prior decisions—specifically referencing what he termed a “mess” left by current SEC Chair Gary Gensler.

While Giancarlo did not elaborate on his concerns, industry veterans speculate that his remarks relate to Gensler’s approach of “regulation by enforcement.” This method, which has drawn criticism from various quarters, has been labeled a “disaster” by one of the SEC’s own commissioners. Herein lies a significant point of contention: the direction of cryptocurrency regulation in the United States, an area where clarity is sorely needed.

Giancarlo, affectionately known as “Crypto Dad” since 2018, has been an advocate for the cryptocurrency sector and its integration into the traditional financial landscape. His tenure at the CFTC began in 2017, a period during which he offered a more amicable approach toward emerging digital assets, suggesting that cryptocurrencies are enduring staples rather than fleeting innovations. Following his departure, he has continued to support the crypto community, even penning an autobiography advocating for the industry’s future.

Currently, Giancarlo serves as an advisor for the US Digital Chamber of Commerce, a testament to his ongoing influence in digital finance. His critiques of the SEC’s heavy-handed regulatory strategy further underscore a widening rift in financial regulation philosophy—one that prioritizes enforcement over guidance.

In response to criticisms, SEC Chair Gary Gensler defended his agency’s regulatory strategies at a recent conference, underscoring the need for a robust framework that encompasses the vast array of digital assets in existence. Gensler delineated that while Bitcoin is not categorized as a security, a significant number of other cryptocurrencies likely meet this classification, warranting SEC oversight.

Moreover, Gensler articulated his stance on the necessity of registration for sellers and intermediaries in the cryptocurrency space, framing the SEC’s actions as vital for safeguarding investors and maintaining market integrity. He highlighted past incidents where a lack of regulatory structure resulted in considerable investor losses, justifying the SEC’s vigilant monitoring of the industry.

Despite Gensler’s assurances, the SEC’s aggressive legal approach—targeting major players like Binance, Coinbase, Kraken, and Ripple—has triggered widespread criticism. Many in the crypto sector assert that the SEC has not only failed to clarify its regulatory expectations but has also created an environment of fear and uncertainty that stifles innovation.

This ongoing tension between regulatory enforcement and the burgeoning cryptocurrency ecosystem illustrates the intricate challenges faced by regulators keen on protecting investors while also fostering an environment conducive to technological advancement. As the debate continues, the voices of both proponents and critics will shape the future of digital asset regulation in the United States.

Leave a Reply