The Bitcoin market is experiencing a retracement higher as bulls set their sights on a price target of $40,000. Cryptocurrency traders are showing a keen interest in Bitcoin Minetrix, a new stake-to-mine Bitcoin alternative, as its Initial Coin Offering (ICO) surpasses $4 million. Despite recent news regarding the delay of a decision on the first spot Bitcoin Exchange-Traded Fund (ETF) application by the US Securities and Exchange Commission (SEC), Bitcoin has managed to rally strongly. With a current trading price of $37,422, up 4.2% in the past 24 hours, Bitcoin has outperformed all other asset classes this year, boasting a remarkable 123% gain. As the market anticipates the eventual approval of a spot Bitcoin ETF, investors are looking to alternative investment propositions that offer exposure to the ongoing bull run.

Introducing Bitcoin Minetrix: A Revolutionary Tokenized Cloud Mining Solution

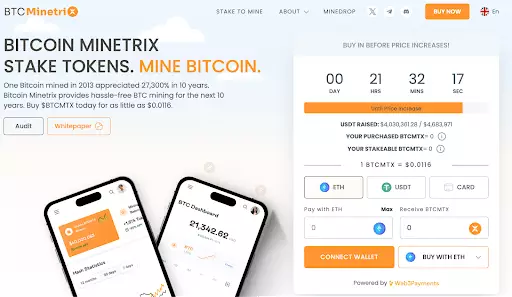

Bitcoin Minetrix (BTCMTX) is a unique crypto asset that has garnered immense attention, attracting a torrent of $4 million in its presale. This one-of-a-kind platform is built on the Ethereum blockchain and allows users to stake the BTCMTX native token, receiving cloud credits in return to mine Bitcoin. Compared to the dominant cloud mining models, Bitcoin Minetrix offers several advantages, including ease of use, low cost of entry, and enhanced security with a reduced risk of scams. As the market awaits the anticipated spot Bitcoin ETF approval, Bitcoin Minetrix has gained popularity as an attractive investment option during the current bull cycle.

The potential value of Bitcoin remains uncertain, but many analysts speculate that it could reach multiples of $100,000. With a sustained increase in price targets, it is widely believed that the market has surpassed the bear cycle’s bottom. Key metrics, such as the market value to realized value ratio (MVRV), indicate that the average Bitcoin holder is now in profit, signaling a potential market bottom. This development, combined with the entrance of major players like BlackRock into the crypto space, further strengthens the optimism surrounding Bitcoin’s future. BlackRock, the world’s largest fund manager with assets under management of $8.54 trillion, recently announced its application to launch a spot Bitcoin ETF. Once approved, this ETF is expected to attract billions of dollars into the cryptocurrency market, granting financial advisors and pension fund managers a regulated route to invest in digital assets.

The Significance of a Spot Bitcoin ETF in the Largest Capital Market

The launch of a spot Bitcoin ETF in the largest capital market, the United States, is poised to have a seismic impact on the cryptocurrency industry. With the combined valuation of the equity and fixed-income ETF sector reaching $7 trillion, the potential inflow of funds into the crypto space cannot be underestimated. This milestone will provide Bitcoin with the credibility it may have lacked in certain circles, especially among institutional investors. As the number of Bitcoin wallet addresses valued at over $1 million continues to rise, along with an increase in high-net-worth individuals investing in Bitcoin, novel coins like Bitcoin Minetrix are gaining traction. Bitcoin Minetrix offers investors the prospect of capital and income growth, allowing them to benefit from both the overall Bitcoin investment story and mining rewards.

Further evidence supporting the supply shock theory is the significant decrease in Bitcoin balances held on exchanges. These balances have reached a five-year low, indicating that significant amounts of Bitcoin are being withdrawn from exchange platforms. This trend contributes to the scarcity narrative and strengthens the case for a continued upward trajectory in Bitcoin’s price.

Bitcoin’s resurgence and the market’s anticipation of a spot Bitcoin ETF approval have created a booming interest in alternative investment propositions such as Bitcoin Minetrix. As the industry evolves and institutional players enter the market, cryptocurrency investors have a growing range of options to participate in the ongoing bull run. With the potential for significant price increases and increased adoption, Bitcoin and its alternatives continue to attract attention and fuel excitement among traders and investors alike.

Note: This article is provided for informational purposes only and does not constitute investment advice.

Leave a Reply