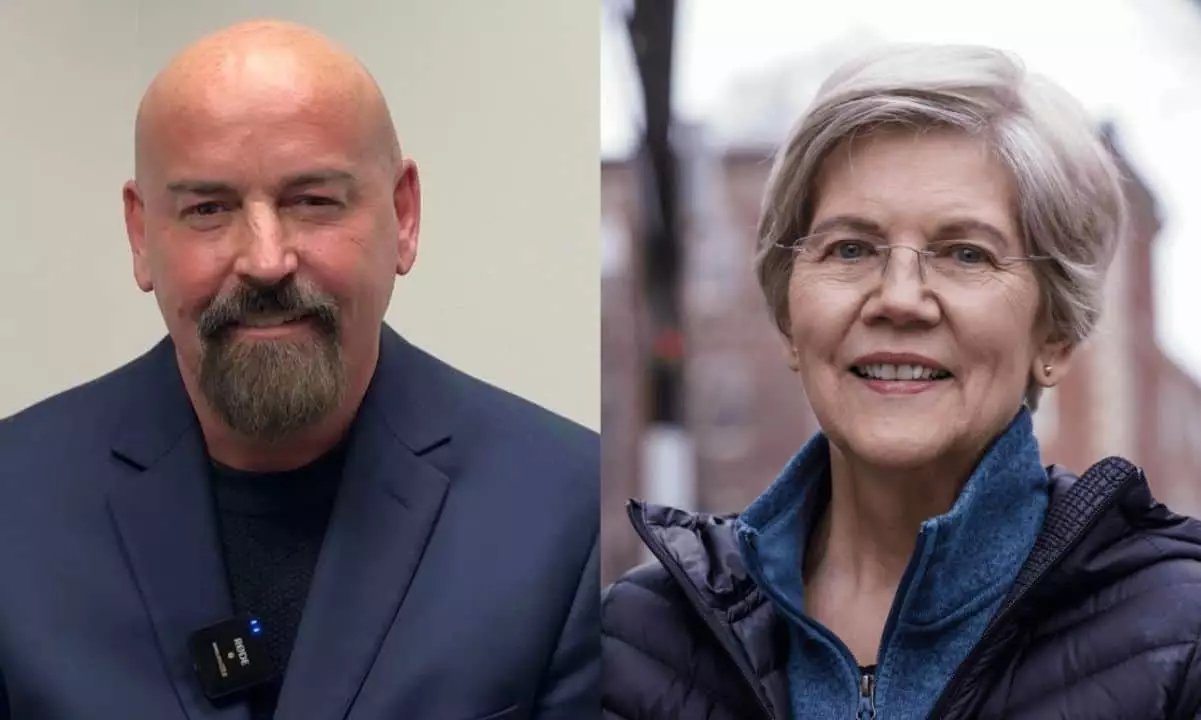

The recent debate between Elizabeth Warren, the incumbent senator from Massachusetts, and John Deaton, a prominent advocate for cryptocurrency, marked a significant moment in the ongoing discourse surrounding digital assets and regulatory frameworks. This clash of ideologies not only illuminated the distinct perspectives on cryptocurrencies but also reflected broader societal concerns regarding financial inclusion and the dynamics of power within the financial sector.

Contrasting Visions for Finance

At the heart of the debate were starkly opposing visions for the future of finance. Warren, a seasoned politician with a track record of advocating for consumer protections and financial reforms, positioned herself against the rapid proliferation of cryptocurrencies. She argued that cryptocurrencies pose substantial risks not only to consumers but also to the overall integrity of the financial system. Her approach appears rooted in a desire to hold emerging financial technologies to the same accountability standards that traditional banks face, emphasizing regulatory oversight to safeguard the public.

In contrast, Deaton approached the discussion from a libertarian perspective, arguing that cryptocurrencies symbolize an essential shift towards empowering individuals financially. He pointed out that cryptocurrencies could particularly benefit those who have been historically marginalized by traditional banking systems, such as the unbanked and those with limited access to financial services. By recounting personal anecdotes about his mother’s struggles with predatory banking practices, Deaton effectively illustrated how cryptocurrencies could provide much-needed alternatives for underserved populations. His arguments, steeped in personal narrative, were intended to resonate on an emotional level, providing context to the numbers and policies being debated.

The debate also raised complex questions about the relationships between politicians and the financial sectors they regulate. Warren accused Deaton of being potentially compromised due to his significant fundraising ties to the cryptocurrency industry. This allegation pointed to a larger issue of integrity and accountability in political financing. Deaton was quick to redirect this narrative, claiming that Warren herself has benefited from corporate PACs, implying that no candidate is free from the influences of special interest groups. This segment of the debate underscored the pervasive nature of financial influence in politics, pushing audiences to consider who really stands for the interests of the average citizen.

Deaton’s rebuttal regarding donations from Ripple’s co-founder to other political campaigns also revealed an aspect of the political landscape often overlooked—a web of financial contributions that can sway policy decisions across the board. These dynamics present a convoluted picture where individual politicians’ intentions may be questioned based on their funding sources, thus complicating the trust voters place in their elected officials.

The Regulatory Frontier: Who Benefits?

As the debate progressed, it became evident that both candidates had differing interpretations of what effective regulation could look like. Warren took a firm stance on the necessity of regulating digital assets to prevent illicit activities, arguing that cryptocurrencies could facilitate crime, terrorism financing, and other illegal acts. Yet, Deaton passionately countered this assertion, suggesting that Warren’s regulatory approach often seemed to benefit established financial institutions at the expense of individual users. His critique extended to legislation that would allow banks to manage Bitcoin while restricting individuals from exercising self-custody over their assets, framing it as a policy that protects the elite rather than the common person.

This dialogue forced the audience to grapple with profound questions: Are regulations being designed to genuinely protect consumers, or are they merely reinforcing the interests of powerful financial institutions? Deaton’s argument emphasized that regulations can inadvertently stifle innovation and limit consumer choice, particularly for those looking to navigate around a banking system that has often let them down.

The Warren-Deaton debate serves as a microcosm of a larger conversation regarding not just cryptocurrencies but also the transformation of our financial systems. As we delve deeper into the implications of digital currencies, it raises essential questions about equity, accessibility, and the future of money itself. The implications of this debate may resonate far beyond the political sphere, shaping conversations around justice and prosperity in an increasingly digital world.

In this climate of rapid innovation and evolution, both proponents and critics of cryptocurrencies must engage in constructive dialogue, not only to carve out a balanced regulatory framework but also to envision a financial future that prioritizes inclusivity and equitable access for all. The contested narratives articulated by Warren and Deaton reflect the complexities and challenges we currently face as a society grapples with the intersection of technology and finance.

Leave a Reply