In a recent filing on September 22nd, it has been alleged that the co-founders of the now-defunct Terra blockchain project had planned to carry out fraudulent transactions during the development of the project. The Securities and Exchange Commission (SEC) claimed that Terraform Labs, the company behind the Terra blockchain, collaborated with a payments app called Chai with the intention of settling transactions on-chain. However, according to the SEC, the leaders of Terraform Labs “faked Chai payments onto the Terraform blockchain” while the actual Chai payments were executed traditionally.

The Involvement of Terraform Labs and Chai

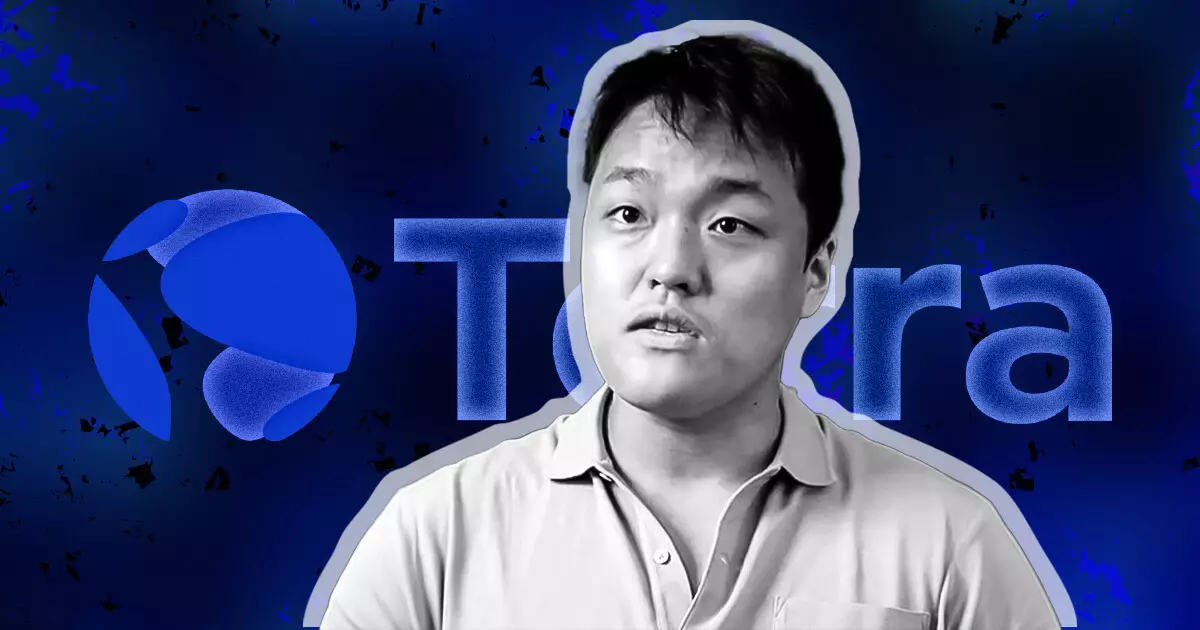

Terraform Labs, headed by co-founder and former CEO Do Kwon, partnered with Chai, which was created and led by another Terraform Labs co-founder, Daniel Shin. This collaboration aimed to enable Chai to settle transactions on the Terra blockchain. However, the SEC claims that the leaders of Terraform Labs discussed the possibility of falsifying transactions to support their activities. In chat logs dating back to 2019, Shin and Kwon exchanged messages discussing the implementation of fake transactions, generating fees, and gradually winding down these activities as the Chai app grew.

During their conversation, Shin expressed concerns about end users discovering the falsified activity. Kwon, on the other hand, seemed confident in his ability to make the fake transactions indiscernible. This exchange raises doubts about the integrity of Terraform Labs’ practices and the extent to which they actually falsified data. It is worth noting that the partnership between Terraform Labs and Chai came to an end in 2020, leaving the exact nature and impact of these fraudulent activities uncertain.

The SEC’s Allegations and Legal Proceedings

The SEC contends that the fraud perpetrated by the co-founders of the Terra blockchain project had significant consequences. They claim that investors bought “hundreds of millions of dollars” worth of LUNA and other tokens, believing that these transactions were taking place on Terra’s blockchain. As part of its efforts to build a securities case, the SEC included the aforementioned chat logs in its filing. The SEC aims to depose Kwon, the former CEO, and require him to testify. However, this request presents challenges as Kwon is currently in Montenegro, where he recently received a prison sentence for forgery of travel documents.

In response to the SEC’s request, defense lawyers have challenged the possibility of extraditing Kwon, claiming that it is “impossible” for him to leave Montenegro. Furthermore, they argued that the chat logs discussed transactions related to staking, rather than the Chai partnership. The defense lawyers’ statements indicate that there may be differing interpretations of the chat logs and the true nature of Terraform Labs’ activities.

Earlier Charges and Allegations

This recent SEC filing is not the first time Terraform Labs, Kwon, and other entities have faced legal action. In February, the SEC initially filed charges against them, accusing them of unregistered securities sales and fraud. The ongoing legal proceedings will shed further light on the allegations and determine the appropriate consequences for those involved.

The allegations of planned fraudulent transactions by the co-founders of the Terra blockchain project have raised serious concerns about the integrity of their activities. The involvement of Terraform Labs and Chai, along with the discussions captured in the chat logs, highlights the potential for misconduct. The SEC’s efforts to depose Kwon and gather testimony will provide valuable insights into the extent of the deception. The outcome of the legal proceedings will determine the accountability and consequences for those involved in this alleged fraud.

Leave a Reply